Employee

An employee is part and parcel of a company. They are expected to work set hours, take breaks, take holiday time etc. in accordance with their individual contract of employment. In return, they receive a salary, pension, paid holiday time, plus any other benefits normally associated with the position.

As part of the contract, the employee is entitled to sickness benefits, maternity or paternity leave, redundancy pay

An employee is generally given work to do by the employer and is obligated to do the work. The employer also has a large amount of control over how, where and when the work is carried out.

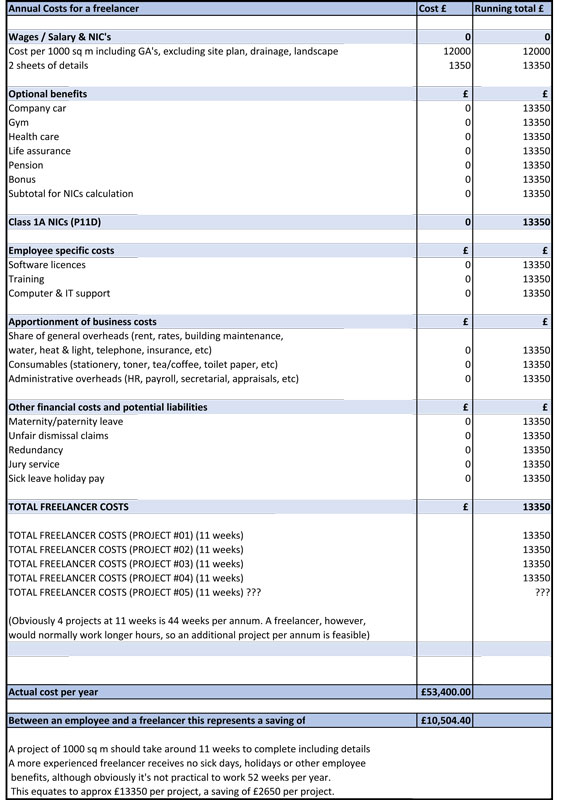

Annual cost to the employer £63,900 based on a salary of £35,000

Advantages of a Full-Time Employee

- Permanent employees are investing their time and energy into making a company successful. Your success is their success. Being treated well breeds loyalty.

- Employees can be diverted to other projects easily but at the expense of other work.

- A good employee is reliable and can be trusted in face to face meetings with clients and contractors.

- You’ll have someone holding down the fort for you in your absence.

Disadvantages of a Full-Time Employee

- Full-time employees expect benefits, like health care, pensions, bonus, paternity leave and holidays.

- You’ll need to pay their salaries on time, even if your business has a slowdown.

- You’ll have payroll paperwork that is legally required. Along with this, you’ll need to withhold employees’ taxes and national insurance contributions.

- You are responsible for your employees’ training and professional requirements.

Annual Cost of an Employee

Agency Contractor

An agency or sometimes a direct contractor are generally self-employed workers who are engaged through a third party. These people will generally work within an employers office on a fixed rate per hour.

Payment is often made by the employer to the agency plus agency fees of up to 30%. The agency will then pay the contractor for the hours agreed with the client.

An agency contractor will generally work within your office using your equipment and software.

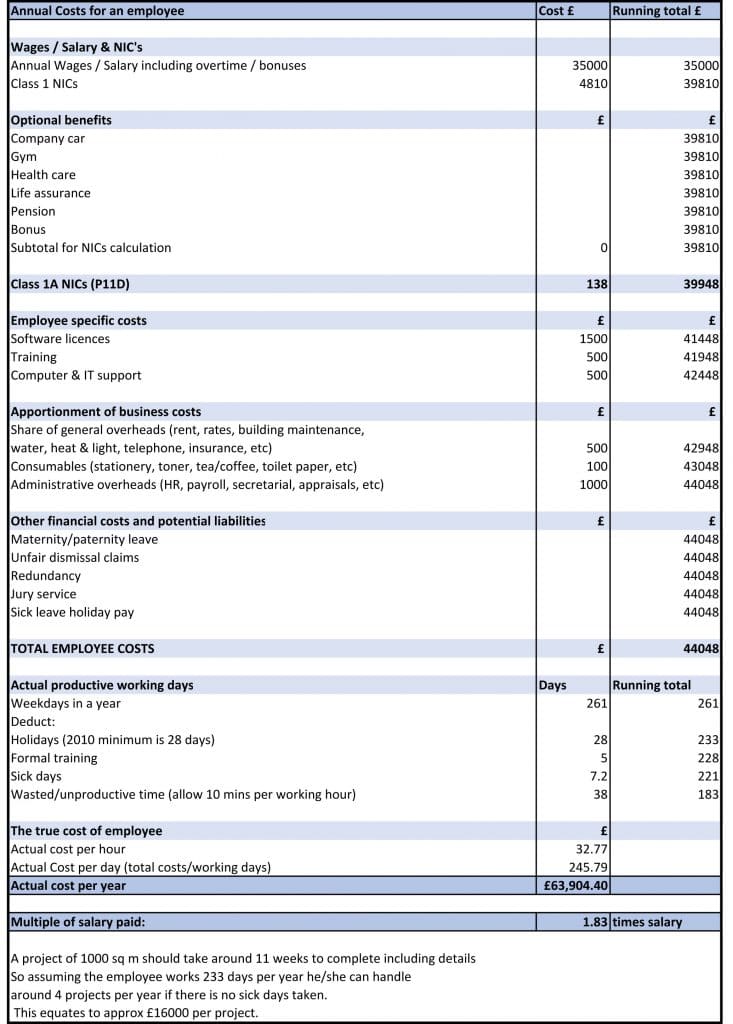

Annual cost to the employer £58,200 based on an hourly rate of £27.50 plus 15% agency fee

Advantages of an Agency Contractor

- Whilst you usually pay more per job or per hour, you will most likely save money overall* since you will not be paying them any benefits and do not need to commit to a salary.

- You have greater flexibility. When you work with an agency contractor and they are not a good match, you simply don’t hire them again. When you have an employee that doesn’t work out, you may need to fire them, which isn’t always easy and may prove expensive.

- You can hire the right person for the task needed, contracting someone with a specialised service.

- They often have many years of experience, so training is not required.

- They are responsible for their own costs relating to training, PPE etc..

Disadvantages of an Agency Contractor

- If the contractor is outside IR35*, you lose control over how tasks are performed, because you can’t closely monitor their work.

- They are hired short term, so you might not get the same worker for your next project.

- They are unlikely to be loyal to your company.

- They are not part of your staff.

- They will not promote your brand.

- The agency will charge a fee between 15-30% for every hour the contractor works. This may include downtime when the contractor is waiting for input from you.

* Assuming the contractor is outside of IR35: Click here for details

Annual Cost of an Agency Contractor

Freelancer

A freelancer is generally engaged directly by an employer, or more accurately, a client, for a specific project. Payment may be on an hourly or daily basis, or as a fixed fee.

The freelancer may have other clients whilst working on your project and will often work remotely only attending client meetings when required.

Payment is made on production of an invoice. Depending on the size of the project, invoices may be issued on the delivery of the project, weekly, monthly or at milestones agreed between the client and the freelancer.

A freelancer will generally work remotely using their own equipment and software.

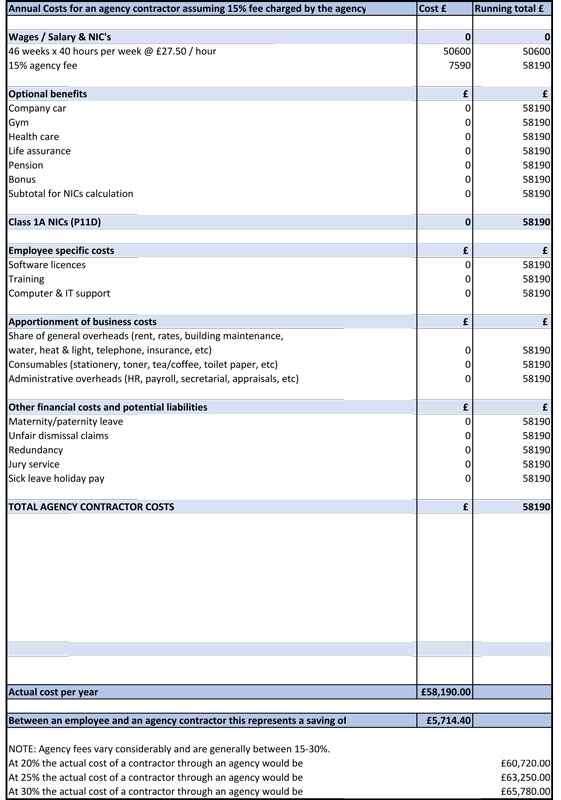

Annual cost to the employer £53,400 based 4 fixed price projects per annum.

Advantages of a Freelancer

- Many have a great deal of experience with lots of different businesses. Each project they work on and each client they collaborate with adds more knowledge and expertise to their arsenal.

- Freelancers cost less than hiring a permanent employee, not necessarily because they charge less, but because they’re much more cost efficient. You don’t have to pay employers taxes, national insurance contributions,* holidays, or additional costs like office overheads, office space, telephone, software or consumables.

- Even at a high hourly rate, you can save money with a freelancer because you only pay for the work they do, especially if they are engaged on a project basis.

- One big plus to hiring a freelancer is the ability to bring in an expert on a project basis. You may just need someone with a specific skillset now, and someone with a different skillset later on. So why hire someone permanently if all you need is a quick turnaround or a task that requires specific expertise for a short period of time?

- The beauty of working with freelancers is that they can provide flexibility in terms of hiring as well as firing.

- You can hire a variety of freelancers on a per-project basis rather than committing to them long-term. This allows you to mix and match talent as your projects and business need changes.

- You can also fire a freelancer when the project has ended or whenever they don’t meet your needs. Unlike the process of firing a permanent employee, ending a contract with a freelancer is usually quick and hassle-free.

- They often have many years of experience, so training is not required.

- They are responsible for their own costs relating to training, PPE, software, office space, etc..

- Whilst you may not get loyalty in the traditional sense from the freelancer, it is very much in the freelancers’ interest to be “loyal” to ensure repeat work is offered to them.

Disadvantages of a Freelancer

- If the contractor is outside IR35*, you lose control over how tasks are performed, because you can’t closely monitor their work.

- They are hired short term, so you might not get the same freelancer for your next project.

- They are not part of your staff.

- They will not promote your brand.

* Assuming the contractor is outside of IR35: Click here for details

Annual Cost of a Freelancer